By Bitgirl, Beaver County Business’s Bitcoin & Crypto Advice Columnist

Listen to a podcast discussion about this article.

Meet the New Money

Every decade or so, Congress invents a law with a name that sounds like it came from a comic book. The latest is the GENIUS Act—short for Guiding and Establishing National Innovation for U.S. Stablecoins. Behind the grand title is a simple promise: if you’re going to issue a digital dollar, you’d better have a real one in the bank to back it up. That’s what a stablecoin is supposed to be—crypto’s boring cousin. One token equals one dollar, no more, no less. The point isn’t to get rich quick. The point is to make it easy to send money fast, cheap, and digital, without the roller-coaster price swings of Bitcoin. In theory, it’s the best of both worlds: the reliability of dollars with the convenience of crypto. In practice, well…we’ll see.

Why This Matters Now

Stablecoins already move billions of dollars a day. Visa, JPMorgan, and Wells Fargo are experimenting with them. If your bank and your favorite Beaver County coffee shop both decide to accept them, they’ll stop being an oddball side project and start being part of everyday life. The GENIUS Act tries to get ahead of that moment, forcing issuers to hold real reserves, obey anti-money-laundering rules, and play nicely with regulators. It’s Washington’s way of saying: “Fine, you can have your digital dollars—but they’d better be real dollars in disguise.”

The Bailout Nobody Asked For

Here’s the catch: if stablecoins grow big enough, they become what economists call systemically important. Translation: too big to fail. Imagine a digital bank run—millions of people trying to cash out stablecoins at once. If the money isn’t really there, the government might step in. That could mean the world’s strangest bailout: taxpayers rescuing a digital token they never even used. Nobel laureate Jean Tirole has already waved the red flag: “Stablecoins could require taxpayer bailouts.” That’s not a sci-fi scenario. It’s a risk today.

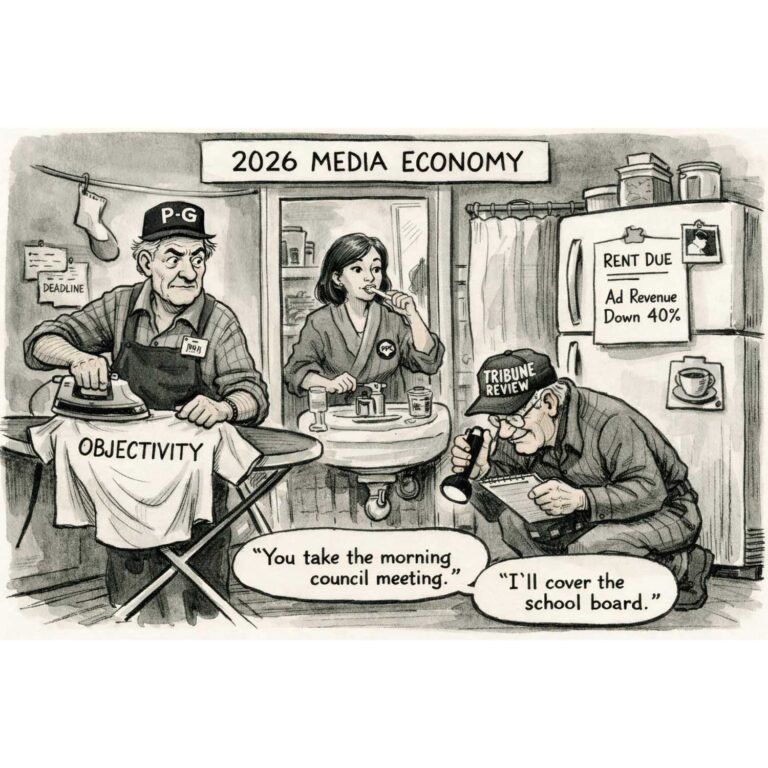

What It Means for Beaver County

- Local banks may one day offer stablecoin transfers as easily as online bill pay.

- Small businesses could accept them, letting you buy pierogies at the farmer’s market with a QR code.

- But risk remains: these tokens are only as solid as the companies and politicians behind them.

If you’re thinking of holding stablecoins as “safe” savings, remember: they’re not FDIC insured. They live and die on trust—and trust can vanish faster than you can say “crypto crash.”

Bitgirl’s Bottom Line

Stablecoins might reshape how money moves. They could make payments smoother and safer. They could also land us with a bailout nobody voted for. So before you swap your paycheck for “digital dollars,” ask yourself: Do you trust Washington to babysit your piggy bank?

Stablecoins in 60 Seconds

- Digital tokens pegged to the dollar

- Designed to avoid Bitcoin’s wild price swings

- Used by banks, payment processors, and traders

- Promise: faster, cheaper global money transfers

- Risk: a digital bank run landing in taxpayers’ laps