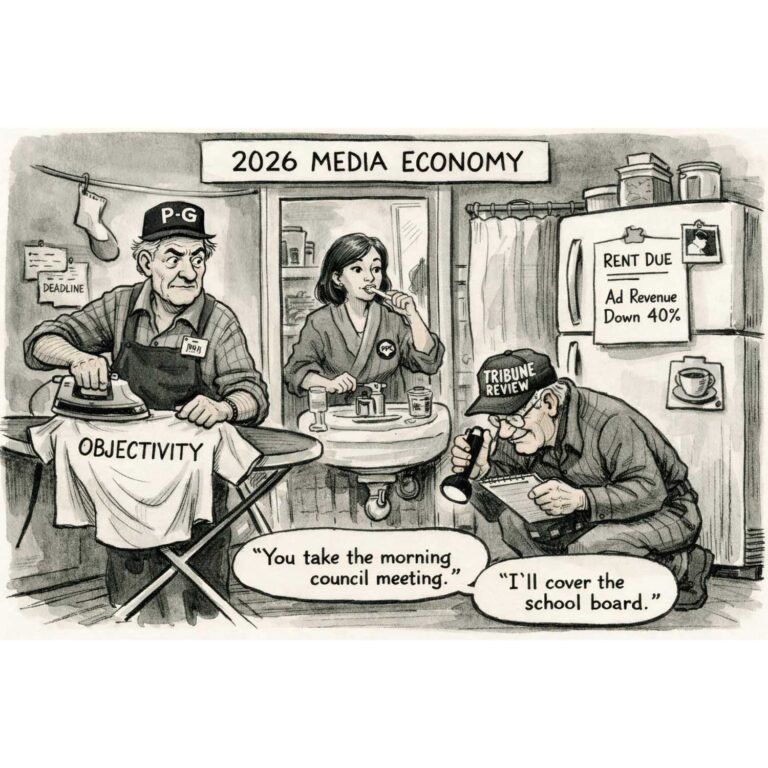

By Rodger Morrow, Beaver County Business Editor & Publisher

Listen to a podcast discussion about this article.

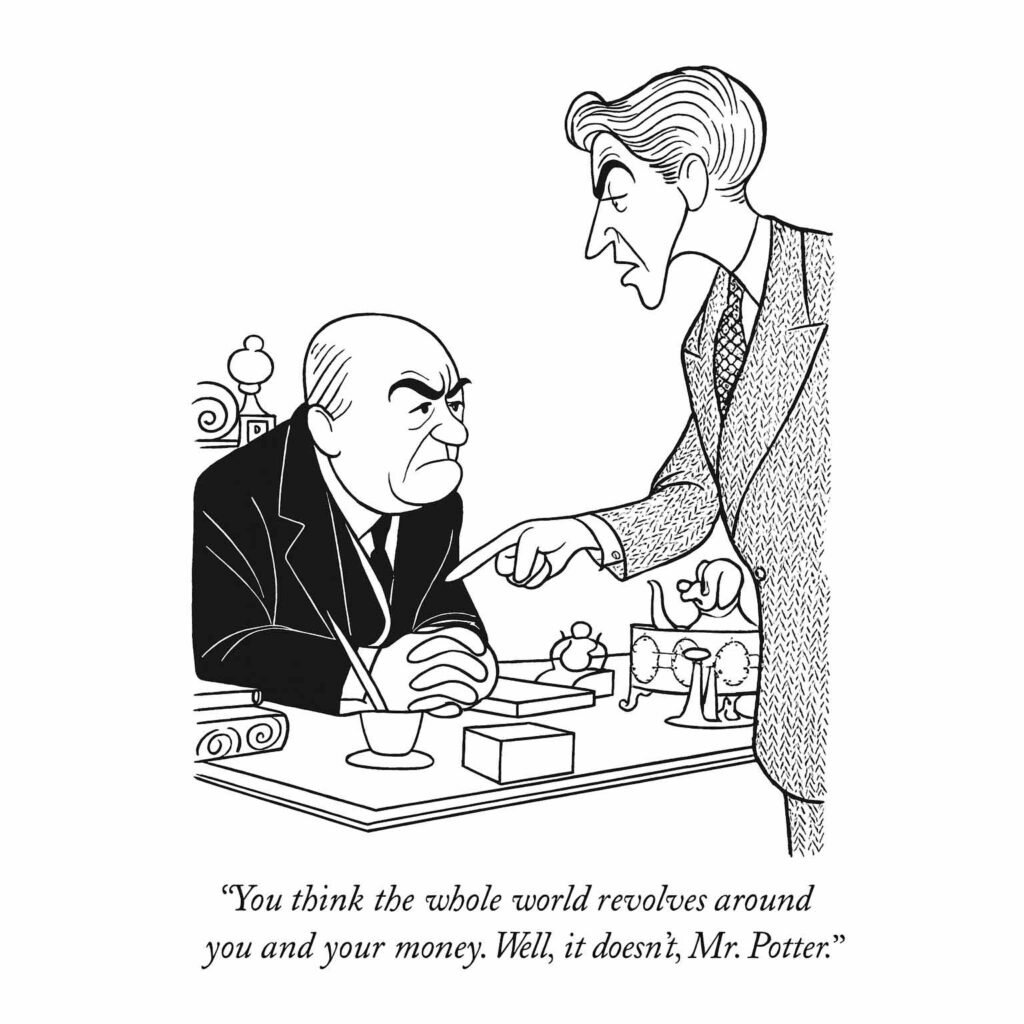

There was a time—still within living memory—when money was something you could look in the eye. Your banker was a man who wore a tie, not a headset. The guy who ran the savings and loan lived up the street, probably bowled on Thursday nights, and lent you money to build a house because he’d seen you mow the lawn for fifteen years without incident. Call it the era of trust: a quaint interval when we believed that thrift, not leverage, was a virtue, and that Jimmy Stewart’s George Bailey really could keep Bedford Falls out of Mr. Potter’s grasp with nothing more than good will and a cigar box full of savings bonds.

Today’s financial villains don’t lurk behind the marble counter of Potter’s Bank. They sit in air-conditioned conference rooms in Washington, D.C., Brussels, and Zurich, speaking fluent banker-ese about “price stability,” “digital currencies,” and “monetary transmission mechanisms.” They can no longer foreclose on your house personally, so they’ve taken to foreclosing on reality itself—turning the idea of money into a kind of behavioral-tracking software.

The new language of control

If you think that sounds paranoid, consider the simple fact that the people who issue our money now propose to program it. Central Bank Digital Currencies (CBDCs, as the acronyms multiply) would allow the same folks who brought you zero-interest rates and trillion-dollar bailouts to decide when, where, and how you may spend your paycheck. They say it’s for “financial inclusion.” What they mean is “surveillance with receipts.”

This isn’t conspiracy; it’s central banking in the twenty-first century. As Saifedean Ammous has argued, easy money is the most elegant form of social control ever invented. When governments can conjure credit at will, they make savers into gamblers and citizens into debtors. Time itself—the one thing we all hold in equal measure—gets discounted. Tomorrow becomes an abstraction, and today turns into a liquidation sale.

From trust to fiat

Under what economists call a “hard money” standard—think gold or, more recently, Bitcoin—people save first and invest later. Capital accumulates slowly, prudently, like topsoil. Under fiat money, by contrast, the soil erodes. You can’t afford to save when the currency is designed to wither in your hand. So you borrow, speculate, and pray that the Fed keeps the plates spinning. The very act of saving becomes an act of defiance.

No wonder the civic virtues have gone missing. A society that lives on borrowed money soon learns to borrow its manners too. In the old savings-and-loan era, we trusted our neighbors because our future depended on them. In the fiat era, we trust algorithms, and our future depends on Jerome Powell’s ego.

How to fight back

There are, fortunately, ways to keep Bedford Falls from turning into Potterville. The first is to do what George Bailey did: build local trust. Bank with the credit union, not the megabank. Shop on Main Street instead of the mall. Subscribe to the local paper (this one will do nicely). Every act of loyalty to your community is a small withdrawal from the account of centralized control.

The second is to own things the central bankers can’t print—or “quantitatively ease.” Gold still glitters, and Bitcoin, whatever your opinion of it, can’t be inflated into worthlessness by a committee vote. There’s even a Bitcoin mine humming away down in Midland, proof that hard money and hard work can still coexist on Beaver County soil.

The moral of the movie

“It’s a Wonderful Life” ends with the townspeople rallying to save George Bailey from ruin, their dollar bills piled high on the table like a declaration of faith. In our own digital sequel, the test is the same: whether we can summon enough trust—in one another—to resist the seductions of Potter-coin and the long arm of the central bank.

Because once you let the Mr. Potters of the world run your money from a laptop in Zurich, you may wake up one morning to find they’ve turned your hometown into a theme park of dependence—and they’re charging admission.

So build your own Bedford Falls while you still can. And remember: every honest dollar saved in Beaver County is a small act of rebellion against the empire of easy money.