By Rodger Morrow, Editor & Publisher, Beaver County Business

Listen to a podcast discussion about this article.

There are lots of ways to ruin a party. You can knock over the punch bowl. You can tell Aunt Linda what you really think of her cranberry salad. Or, if you happen to be the Bank of Japan, you can casually raise interest rates after thirty years of pretending money grows on bonsai trees.

And just like that, Bitcoin—once galloping toward six-figure glory—slid down the embankment like a shopping cart set loose from the Brighton Hot Dog Shoppe parking lot.

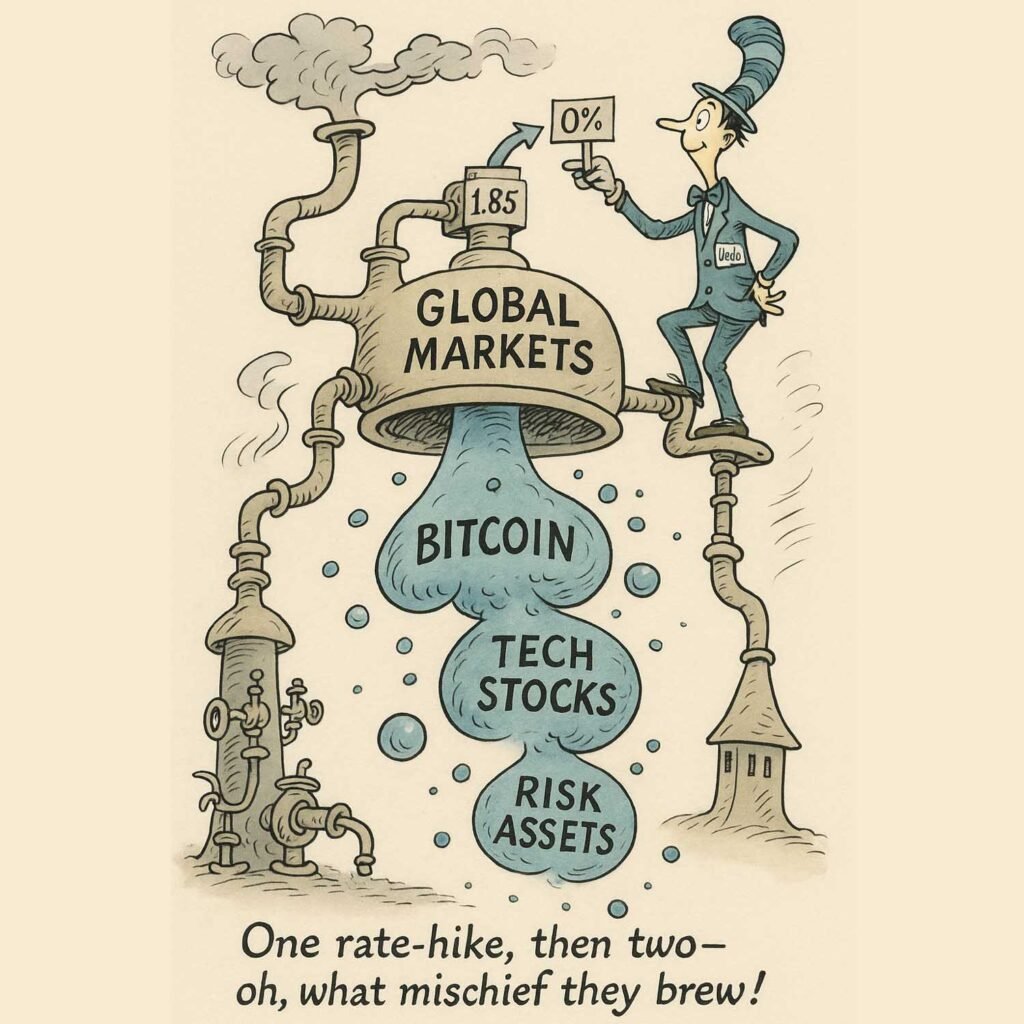

In late 2025, Bitcoin tumbled from a giddy $126,272 to a more chastened $86,000. Crypto purists blamed manipulation, moon cycles, and the usual gallery of unseen forces. But as Shanaka Anslem Perera patiently explains, the culprit was neither mystical nor uniquely crypto. It was the sudden death of the Yen carry trade, that great global mirage in which everyone borrowed near-free Japanese money and levered it into anything that moved—stocks, bonds, real estate, Bitcoin, you name it.

For three decades, this trade operated like a cosmic Swiffer, sweeping trillions of cheap Yen across world markets. Depending on who you asked, the whole thing totaled somewhere between $3.4 trillion and $20 trillion—Wall Street’s version of, “Oh, just a little something I picked up at Costco.”

Then the Bank of Japan, after years of insisting interest rates were just a quirky national tradition, discovered that inflation was real after all. Core CPI hit 2.8%. Prime Minister Sanae Takaichi announced a 21.3 trillion Yen stimulus package that made bond yields rise like a startled pheasant at Brady’s Run. Ten-year JGBs leapt to 1.85%, the highest since 2008. Forty-year yields hit 3.70%, a number previously thought mathematically impossible in Tokyo. The free-money keg was empty.

The Dominoes Start Falling

Once Japanese yields rose, the whole daisy chain went into reverse. Investors who had spent years gallivanting through global markets with borrowed Yen suddenly had to go home and clean their rooms. They repatriated capital. They unwound positions. They discovered, with shock and dismay, that math still works.

The crypto markets—highly leveraged, caffeinated, and prone to melodrama—responded with their usual grace. On December 1 alone, $646 million in crypto positions were liquidated. The first margin calls had the drama of a fainting goat; by October 10, the cascade reached $19 billion. Futures open interest dropped 30%. If Bitcoin had been wearing a Fitbit, the stress metrics would’ve lit up like Emsworth Borough Council on paving night.

The Institutions Remember They’re Institutions

The much-celebrated post-2024 Bitcoin ETFs had ushered in the big boys—BlackRock, Fidelity, and pension funds whose idea of risk-tolerance is changing the brand of coffee in the breakroom. As Perera notes, their interest in Bitcoin was never ideological. They weren’t pumping fists at Bitcoin conferences yelling, “Number go up!” They were simply following liquidity.

And liquidity was leaving the building.

As bond yields climbed and the Fed’s rate-cut fantasies evaporated, institutional flows reversed. In November alone, U.S. Bitcoin ETFs saw $3.45 billion walk out the door. Perera notes that every $1 billion of ETF outflows smacked Bitcoin about 3.4% lower, a ratio that surely warmed the hearts of short-sellers everywhere.

Meanwhile, Bitcoin’s once-vaunted “uncorrelated asset” mystique dissolved. Correlations with the Nasdaq hit 46%, with the S&P 500 hit 42%. Bitcoin, it turned out, wasn’t digital gold—it was tech stocks with a leather jacket and a backstory.

The Whales Smell the Exit

On-chain data confirmed what old fishermen in Rochester have long known: the big ones know when to swim away. Early Bitcoin whales—silent titans who had sat on fortunes since the Obama administration—moved 202,000 dormant coins to exchanges. Mega-holders sold an estimated $12.3 billion. “Diamond hands” turned out to be zirconium.

Yet it wasn’t pure flight. Mid-tier institutions (the respectable aunts and uncles of the crypto family) actually accumulated 375,000 BTC. Miners sold less. The market wasn’t collapsing so much as changing the names on the mailbox.

Governments, Always Looking for Spare Change

Then the regulators waded in, each performing their role with the subtlety of a marching band. China cracked down on stablecoins, shrinking the market by $4.6 billion. The U.S. government sent 20,000 BTC to Coinbase—presumably the digital equivalent of finding a box of cash in the evidence room and deciding to “tidy things up.”

The much-hyped “Strategic Bitcoin Reserve” remained a sort of regulatory Bigfoot—sightings reported, existence unconfirmed.

The Moment of Truth

All eyes now turn to the Bank of Japan’s December 18–19 meeting. Perera suggests that more hikes could push Bitcoin to $75,000. A pause could ignite a short squeeze back over $100,000. In other words, Bitcoin’s immediate fate rests not in halving cycles or hash rates but in the hands of a central bank 6,700 miles away, whose policy decisions move markets the way teenagers move furniture—suddenly and without warning.

What Bitcoin Actually Is

Perera ends with a sober truth: Bitcoin is not digital gold, a monetary revolution, or an inflation hedge. It is a liquidity-sensitive option on the possibility of future monetary rebellion. It thrives when money is loose, whimsy is rewarded, and global central banks behave like doting grandparents. When liquidity tightens, Bitcoin comes down with the rest of the high-beta crowd.

This correction didn’t expose Bitcoin’s weaknesses so much as its nature: not an island apart from the global system, but one of its liveliest, most excitable participants.

The romance may be fading. The realism, as always, remains.

And somewhere in Tokyo, a central banker is quietly cleaning the punch bowl.