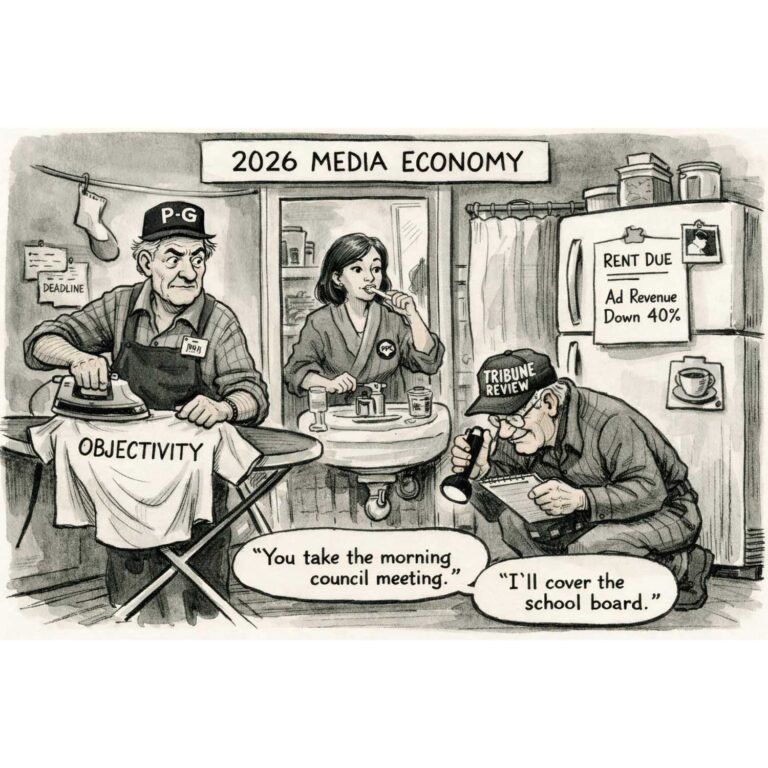

By Rodger Morrow, Editor & Publisher, Beaver County Business

Listen to a podcast discussion about this article.

If you ever opened a bank account in the 1970s…

If you ever opened a bank account in the 1970s and walked out with a free toaster, congratulations—you lived during the last period in American history when banks gave you something other than anxiety. Today the toasters are gone, the fees are up, and JPMorgan Chase has grown large enough to cast shade over multiple time zones.

JPMorgan is no longer a bank. It is a federally chartered savings-eating machine wearing a navy-blue suit. With more deposits than some countries keep in their foreign-exchange reserves and more credit-card business than a Vegas weekend, it has become the private concierge of a monetary system designed to make sure you behave, pay your fees on time, and never wander off into anything as indecorous as financial independence.

Naturally, the Federal Reserve—created to “regulate” banks—has spent more than a century acting like JPMorgan’s emotional support animal. The Fed prints the money, JPMorgan collects the money, and the public is left clapping politely like bystanders at a wedding they weren’t invited to.

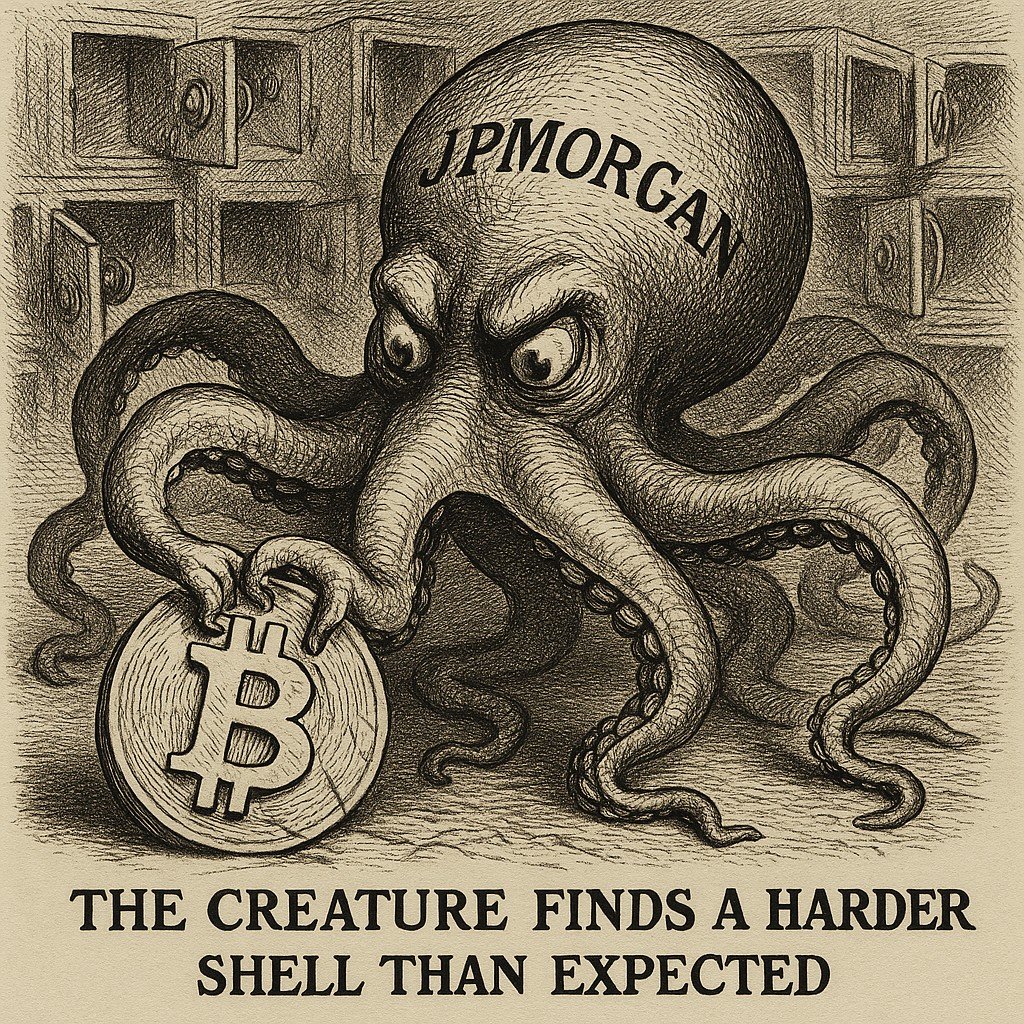

And then Bitcoin showed up, uninvited, wearing flip-flops.

The 2025 Bitcoin “Whoopsie”

In November 2025, Bitcoin—charging toward $126,000 like it had a hot date at the finish line—suddenly tripped over a log and rolled downhill to $84,000. MicroStrategy, Bitcoin’s most enthusiastic corporate cosplayer, plunged 40%. Wall Street called it a “market correction,” which is finance-speak for “we’d rather not explain this because it makes the banks look bad.”

How did JP Morgan accomplish this sleight of hand?

First, the bank jacked up margin requirements on MicroStrategy from 50% to 95% overnight—an act roughly equivalent to your mortgage lender calling to say, “Hey, we’ve decided you owe the whole balance by noon. Chop chop.”

Investors, being fond of owning shirts, were forced to sell into a falling market. Prices cratered. Panic took the wheel.

Then, at the exact moment when the market was ready to faint, JPMorgan analysts began waving around a six-month-old MSCI memo discussing whether companies like MicroStrategy should be reclassified in a way that would trigger billions in forced selling. This memo had been public since summer. No one cared until JPMorgan started shaking it around the trading floor like a cat who just found a dead mouse.

Why Jamie Dimon Has Nightmares About Michael Saylor

Why would the biggest bank in America feel the need to kneecap a tech company with a part-time Bitcoin habit? Because Michael Saylor discovered a way out of the financial prison.

His strategy is beautifully rude:

Borrow cheap money → Buy Bitcoin → Watch banks panic.

It turns a company into its own central bank—one that doesn’t require Jamie Dimon’s blessing or the Fed’s ceremonial incense.

If this idea spreads, it threatens everything: bank vaults, custody fees, the illusion that the banking system is mandatory. It could even threaten Dimon’s favorite recreational activity: going on television to call Bitcoin a “fraud” while his own trading desks buy Bitcoin ETFs like they’re on clearance.

Some might call that hypocrisy. JPMorgan calls it Tuesday.

Back to Jekyll Island, Where the Plot Thickened

To understand where this madness began, we must revisit 1907, when an old-fashioned bank panic sent the U.S. financial system into the garbage disposal. With no central bank in existence, J. Pierpont Morgan—mustache like a bristling badger—decided the country needed adult supervision and personally locked bankers in his library until they agreed to stop the bleeding.

Congress, mortified that a private financier had temporarily replaced the U.S. Treasury, vowed to build a central bank—one with the reassuring appearance of public oversight and the practical function of protecting bankers from themselves.

Thus, in 1910, six powerful men boarded a secret train in Hoboken under fake names and headed to Jekyll Island to design the central bank of their dreams. They burned drafts in fireplaces, used only first names, and acted exactly like men who were definitely, absolutely not conspiring.

Out came the blueprint for the Federal Reserve, which launched in 1913 with member banks (including Morgan-adjacent ones) as its owners.

JPMorgan’s Growth Strategy: Eat Your Competitors During a Crisis

Over the next century, America developed a quaint national routine:

1. Crisis occurs

2. Regulators panic

3. JPMorgan emerges bigger

In the 1930s, Morgan merged with Guaranty Trust.

In the 1970s, it feasted on petro-dollars.

In 1999, the repeal of Glass-Steagall allowed its shotgun marriage with Chase Manhattan.

In 2008, JPMorgan bought Bear Stearns and Washington Mutual at garage-sale prices.

In 2023, First Republic showed up on its doorstep like an abandoned puppy.

By this point, JPMorgan resembles a kind of financial Pac-Man: crisis → chomp → bigger crisis → chomp.

Operation Chokepoint 2.0: Banks as Hall Monitors

The same instincts are now aimed at individuals. Bitcoiners, entrepreneurs, and anyone who dares to move money without saluting first have seen their accounts closed mysteriously.

Banks claim it’s “risk management.” The public suspects it’s “revenge.” Regulators quietly call it “Operation Chokepoint 2.0.”

Why 2025 Was the Panic Point

The Trump administration’s loud embrace of Bitcoin—talk of a strategic reserve, vows to fire anti-crypto regulators, promises to unwind rules like SAB 121—posed the most serious threat to the Morgan-Fed partnership since Teddy Roosevelt brought his big stick to Washington.

Suddenly, Bitcoin wasn’t merely a tech hobby. It was standing on the edge of mainstream monetary policy.

Thus JPMorgan’s November 2025 theatrics: margin hikes, panic memos, and a coordinated scare—perfectly timed for regulatory chaos.

MicroStrategy survived. Bitcoin bounced back. But JPMorgan’s real message was clear: “Try that again and we’ll drop a piano on you.”

“Bitcoin Is Dangerous,” Says the Bank With a Thousand Fines

When a bank that paid:

$290 million to Epstein’s victims

$920 million for precious metals manipulation

and countless other settlements

tells you Bitcoin is “dangerous,” please understand what is meant.

It means Bitcoin isn’t dangerous to you. Bitcoin is dangerous to them.

It threatens the illusion that banks are indispensable. It threatens the ability to freeze, seize, or margin-call your savings into dust. It threatens the 112-year-old gate JPMorgan helped build—and still guards.

Financial freedom does not mean smooth price charts. It means not being supervised.

Bitcoin is the first crack in that gate. And the gatekeepers are terrified.

The only question left is whether you’ll hold the asset the banks are so desperate to scare you out of—or whether you’ll stay inside the system they designed to keep you exactly where you are.