By Rodger Morrow, Editor & Publisher, Beaver County Business

Listen to a podcast discussion about this article.

Why Housing Isn’t the Economy — and What Beaver County’s Boom Really Means

Economists love to say that housing is the foundation of the economy. The New York Times recently echoed this gospel, calling rising home values the engine of prosperity. It’s a comforting idea—and completely wrong. Housing doesn’t drive the economy; it mirrors it.

The Illusion of Growth

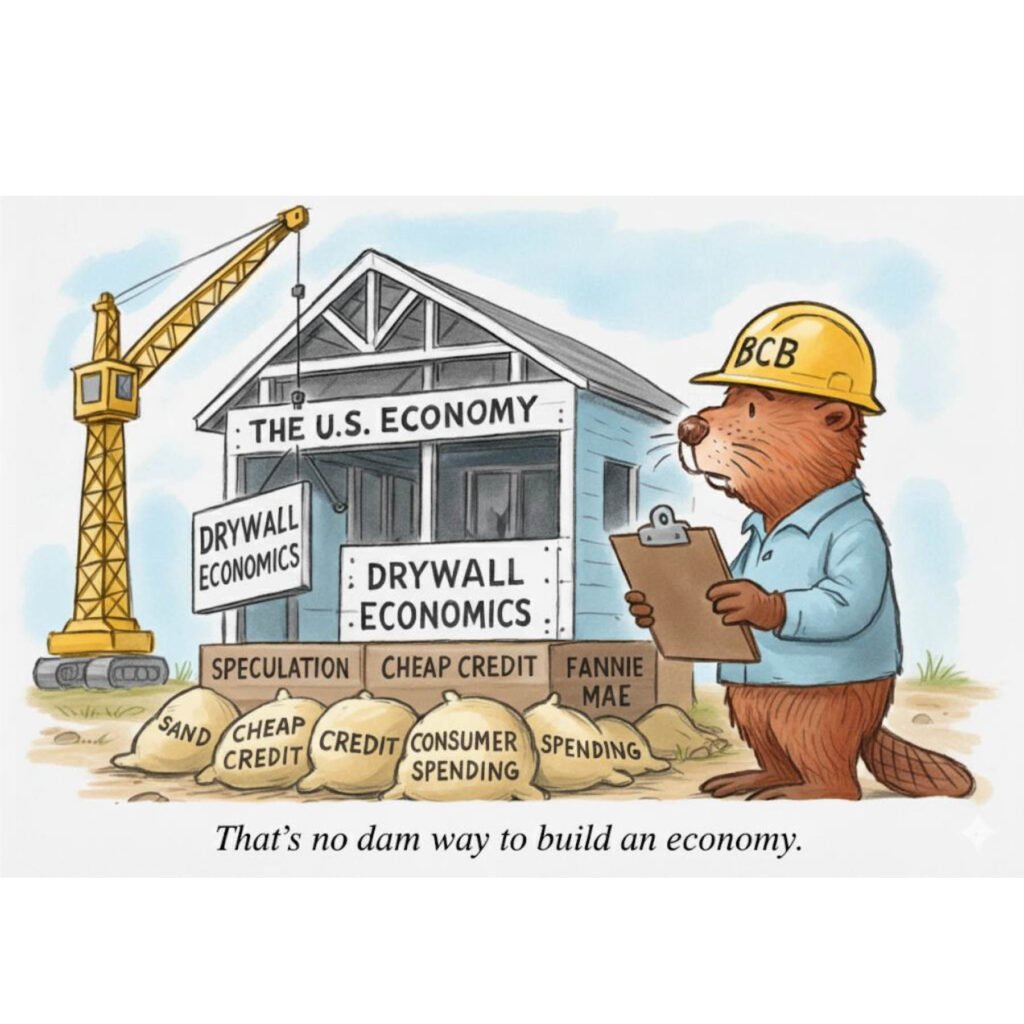

If houses truly powered growth, Silicon Valley would be known for cul-de-sacs instead of chips, and Beverly Hills for its drywall, not its dreams. Prosperity follows production, not consumption. We build wealth by creating value, not by inflating home prices or refinancing our way to riches.

Lessons from the Mortgage Myth

In the early 2000s, I helped Fannie Mae sell the myth that homeownership created wealth. We called it “the American Dream.” Then 2008 arrived, and the dream turned to dust. Housing wasn’t wealth creation—it was leverage disguised as progress.

Beaver County’s Real Boom

Today, Beaver County’s housing market is hot—median prices up 10 percent, listings jumping 30 percent—but that’s not proof of economic leadership. It’s a reflection of what’s happening beneath the surface: Mitsubishi expanding, energy companies reviving sites, and manufacturers rediscovering the Ohio River corridor. The work, not the mortgages, drives the boom.

The Policy Trap

When Washington mistakes consumption for investment, it builds on sand. Mortgage deductions and capital-gains breaks encourage us to pour capital into drywall instead of dynamism, inflating prices while starving innovation, education, and infrastructure. We’ve seen where that road ends—in foreclosure.

The Real Foundation

Home prices aren’t wealth creation; they’re wealth transfer. Beaver County’s future depends on what it makes, not what it mortgages. Growth will come from productivity, not plywood. Around here, prosperity is built by people who work, weld, teach, and reinvent—not by housing markets that rise and fall with interest rates.

The Takeaway

The true foundation of the economy isn’t the mortgage—it’s the paycheck. The American Dream endures not because of leverage, but because of labor.