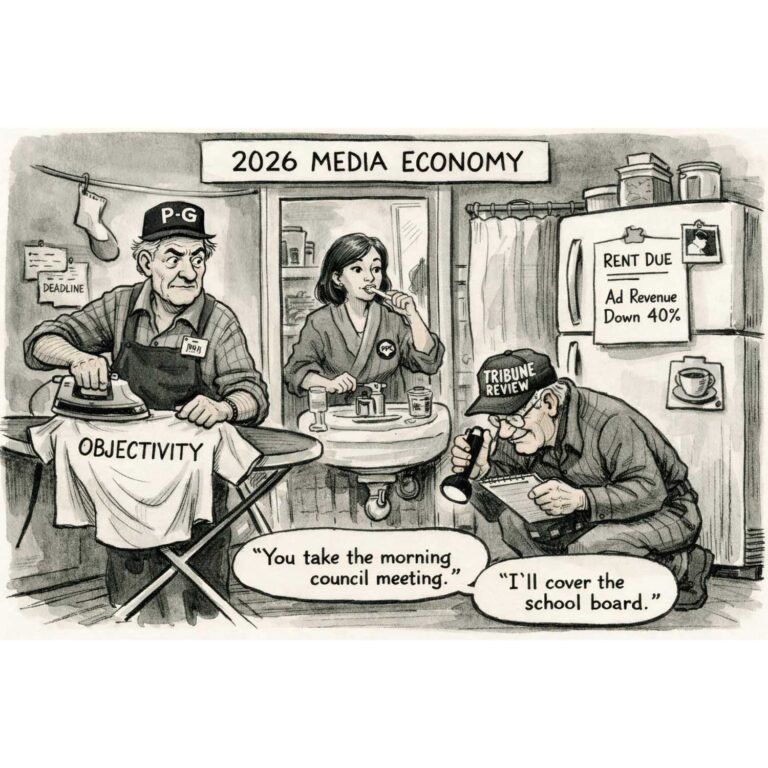

By Rodger Morrow, Editor & Publisher, Beaver County Business

Listen to a podcast discussion about this article.

If you had walked into a Beaver County diner in 1978 and announced that everyone in the room needed a personal computer, you would have been politely escorted back to your seat and advised to lay off the coffee. Computers were large, expensive, temperamental, and—most importantly—optional. You could live a perfectly normal life without one.

Money, unfortunately, does not enjoy that luxury.

Which brings us to Bitcoin. Or, more precisely, to why everyone in Beaver County— steelworkers and software developers, retirees and twenty-somethings, people who still remember ration books and people who think floppy disks are a TikTok dance—needs at least a working understanding of it.

The clearest explanation I’ve heard recently comes from Parker Lewis, head of business development at Zaprite and author of Gradually, Then Suddenly. Lewis calls Bitcoin “the greatest asymmetry in the world,” which sounds like something you’d hear in a geometry class until you realize he’s talking about your paycheck.

Lewis frames Bitcoin around three ideas, each of which should resonate deeply in a county that has seen booms, busts, and the occasional miracle.

First, absolute asymmetry. Bitcoin, Lewis argues, is a binary bet. Either it fails completely and goes to zero, or it succeeds and becomes a global monetary standard. There is no polite middle ground where it merely muddles along. The downside is limited—you can only lose what you put in. The upside, however, is measured in orders of magnitude. Beaver County understands asymmetric bets. Every bridge, mill, and cracker plant here was built on the same logic: big risk, bigger payoff, and no guarantees.

Second, finite surface area. Most investments fail because they depend on a thousand unknowable variables—management, competition, regulation, timing, luck. Bitcoin depends on exactly one thing: whether it can credibly enforce its fixed supply of 21 million units. That’s it. No earnings calls. No CEOs. No surprise share issuance at 4:59 p.m. on a Friday. For a county that once trusted pensions backed by promises rather than math, this distinction matters.

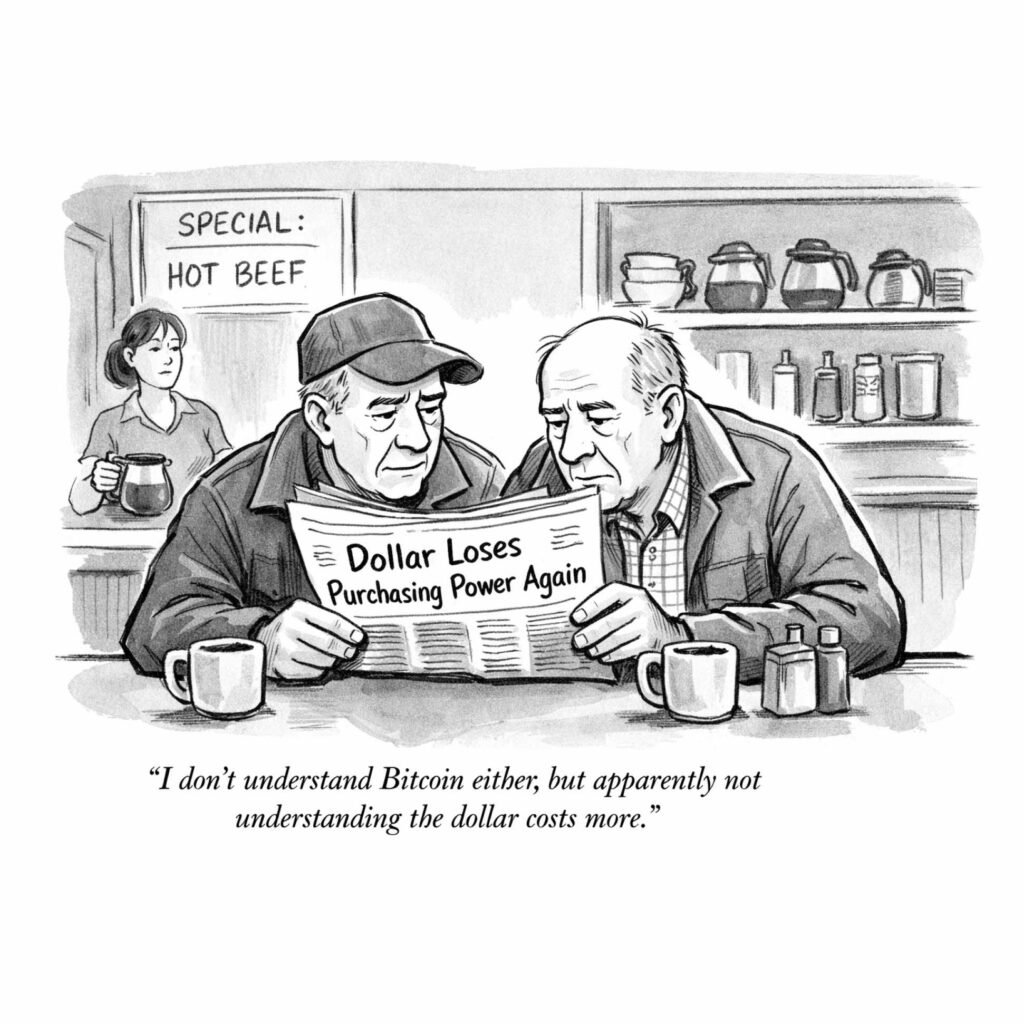

Third—and this is the part that makes Bitcoin unavoidable—the negative asymmetry of fiat currency. Not owning Bitcoin is not like missing out on Apple stock in the 1990s. It’s more like insisting you don’t need a coat in February because you’ve always done fine without one. The problem, Lewis explains, is that fiat money has a math problem. The United States carries over $100 trillion in debt supported by only a few trillion in base money. The Federal Reserve is trapped in a Catch-22: stop printing and risk a credit collapse, or keep printing and quietly debase everything you’ve ever saved.

In Beaver County terms, this is like trying to run the county budget by refinancing your credit card every year and hoping interest rates stay friendly forever. Hope, as history suggests, is not a strategy.

Lewis also addresses the standard objections. Quantum computers? Bitcoin can adapt. The protocol has changed before and can change again if real threats emerge. Energy use? He points to Texas, where Bitcoin miners help stabilize the grid by acting as instant, flexible demand—shutting down the moment people need power. The grid operator there, ERCOT, has learned something Beaver County knows well: systems survive by balancing load, not by pretending demand doesn’t exist.

Then there’s timing. Lewis estimates that fewer than one percent of the world truly understands Bitcoin today. In eight to ten years, he believes, it will no longer be volatile because it will have become boring—money as a standard rather than a speculation. By then, asking whether you “believe” in Bitcoin will sound a bit like asking whether you believe in accounting.

Which brings this home to Beaver County Business. This county has lived through what happens when systems change faster than people expect. We know what it feels like to wake up one morning and discover the rules have been rewritten overnight. Bitcoin is unusual because it offers a chance to see that rewrite in advance.

Lewis closes his lecture by calling Bitcoin “a strange game where the only winning move is to play.” That’s not a gambler’s slogan; it’s a recognition of asymmetry. You don’t need to love Bitcoin. You don’t need to day-trade it, evangelize it, or put laser eyes on your Facebook profile. You simply need to understand why a fixed supply in a world of unlimited promises changes everything.

Beaver County has always survived by adapting—sometimes late, sometimes painfully, but usually just in time. Bitcoin isn’t about getting rich quick. It’s about opting out of a system that quietly ensures you get poorer slowly.

And if there’s one thing this county understands, it’s the difference between slowly and suddenly.